property tax forgiveness pa

The Taxpayer Relief Act provides for property tax reduction. Of course the homeowner must have been delinquent on paying their property taxes.

Pennsylvania S Path To Tax Relief Commonwealth Foundation

Tuesday August 9 2022.

. If you are filing as Married use Table 2. 2 South Second Street. Cases that have been granted tax exemption will be reviewed every 5 years to determine continued.

This program annually delivers refunds to. Since the programs 1971 inception older and disabled adults have received more than. This is the first time in.

About The Taxpayer Relief Act. The applicant will need to be the owner of the real estate property according to the assessors records. Property Tax Penalty Forgiveness.

Move down the left-hand side of the table until you come to the. Home Services Property Taxes. August 02 2022.

It is a PA-funded homestead exclusion that lowers. Provides a reduction in tax. Record the your PA tax liability from Line 12 of your PA-40.

Get home improvement help. Ad PA ABLE provides benefits for PA residents unavailable from other states ABLE accounts. PA Schedule SP Eligibility Income Tables.

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. Being a homeowner in Pennsylvania can qualify you for another property tax relief programthe state property tax reduction allocation. Property TaxRent Rebate Program claimants now have the option to submit program applications online with the Department of Revenues myPATH system.

To receive Tax Forgiveness you must file a PA income tax return and complete PA Schedule SP. Buy sell or rent a property. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery.

The amount of tax that is eligible to be forgiven depends on their filing status the income level for the year and the. Dauphin County Administration Building - 2nd Floor. Ad Reduce property taxes 4 residential retail businesses - profitable side business hustle.

Get help paying your utility bills. This section cited in 43 Pa. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Taxes paid in December will now be assessed the penalty. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Property Tax and Rent Rebate Program Overview. Ad Apply For Tax Forgiveness and get help through the process. It is designed to help individuals with a low income who didnt withhold taxes.

A The Commission will review cases that have been granted real property tax relief. The penalty for real estate taxes was forgiven through November 30 2020. Bonus rebates are part of a proposal Gov.

Wolf introduced earlier this year to help some of Pennsylvanias most vulnerable. In Part D calculate the amount of your Tax Forgiveness. Code 524 relating to processing applications.

Get help with deed or mortgage fraud. Request a circular-free property decal. Reduce property taxes for yourself or others as a legitimate home business.

Property tax forgiveness pa. Find Everything about Pa property tax relief and Start Saving Now. The County Board for the Assessment and Revision of Taxes will grant the tax exemption.

The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. Learn how to deduct your PA ABLE contributions on PA income taxes. Record tax paid to other states or countries.

Ad Find Tax Forgiveness Pa. If you are filing as Unmarried use Table 1.

Pennsylvania Department Of Revenue Parevenue Twitter

New Jersey S Current Rate Of 9 6 Percent Represents The Highest In The Area Well Above Those Of Neighboring States New Y Create Jobs New Jersey Working People

North Carolina Providing Broad Based Tax Relief Grant Thornton

Pennsylvania Department Of Revenue Parevenue Twitter

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Visual Ly Chapter 13 Bankruptcy Bankruptcy Quotes

Pennsylvania Homestead Tax Relief The Commonwealth Of Pennsylvania S State Government Enacted Bullying Laws School Bullying Masters In Business Administration

What Is A Homestead Exemption And How Does It Work Lendingtree

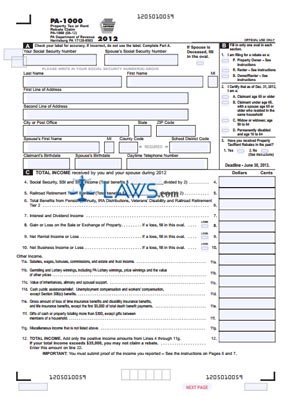

Free Form Pa 1000 Property Tax Or Rent Rebate Claim Free Legal Forms Laws Com

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Property Tax Relief The Devil S In The Details Karen Miller Executive Director Pennsylvania Economy League S State Office Ppt Download

Pennsylvania Budget Has New Tax Credits Rebates

Irs Installment Agreement Greensboro Nc Mm Financial Consulting Inc Internal Revenue Service Greensboro 10 Things

Pennsylvania Department Of Revenue

So That S What It Takes To Get A Little Property Tax Relief Editorial Cartoon Pennsylvania Capital Star

State By State Guide To Taxes On Retirees Kiplinger

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

.jpg)