maine tax rates for retirees

Many retirees need more than Social Security and investment savings to provide for their daily needs. The five states with the lowest overall.

Maine Sales Tax Small Business Guide Truic

United Van Lines 2020 National Movers Study.

. Retirees get tax breaks but must contend with high property taxes. Maine 58 to 715. Highlights of the supplemental budget include.

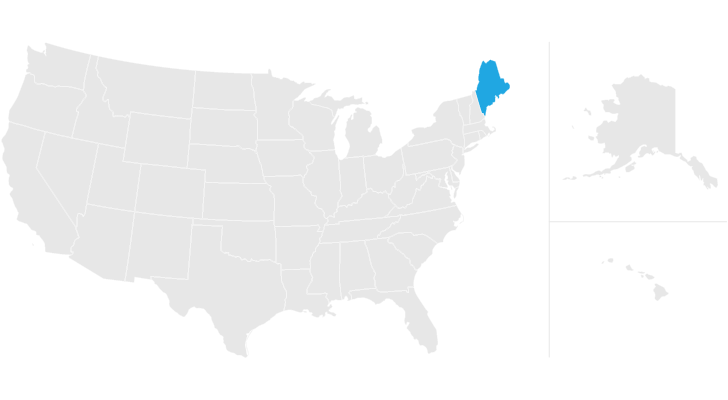

Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax. You pay a premium to the insurance company. That initial investment will grow tax-deferred throughout the accumulation phase typically anywhere from ten to 30 years based on the terms of your contract.

Which States Are the Most Tax-Friendly for Retirees. More Property Tax Relief. Best CD Rates in Alabama AL - August 25 2022.

Social Security is exempt from taxation in Maine but other forms of retirement income are not. Compare the best One-year CD rates in Alabama AL from hundreds of FDIC insured banks. So when youre comparing sales tax rates from state to state look at both the combined state and local sales tax.

Compare the best One-year CD rates in Indiana IN from hundreds of FDIC insured banks. Retirees moreover are freer to consider factors like taxation than those who are tied to a job. Thirteen states exempt pension income for qualified retirees as of the tax year 2021.

An estimated 100000 low- and middle-income property owners and renters. California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also implements an additional tax on those with income of 1 million or more which makes its highest actual tax rate 133. No Social Security tax.

They can diverge quite a bit based on factors such as income tax rates and whether Social Security payments are taxed. Is Maine tax-friendly for retirees. Or have no income tax at all.

Maine Relative tax burden. Explore our weekly state tax maps to see how your state ranks on tax rates collections and more. Most states that have an income tax also allow retirees to exclude some or all of their Social Security benefits and pension incomes from taxation.

Hawaii is an example of a state friendlier toward lower-income retirees than. According to the Tax Foundation. Tax Break for Maine Retirees.

Seniors who receive retirement income from a 401k IRA or pension will pay tax rates as high as 715 though a small deduction is available. Compare the highest CD rates by APY minimum balance and more. Best CD Rates in Indiana IN - August 25 2022.

Compare the highest CD rates by APY minimum balance and more. Provides 7 million in ongoing General Fund dollars to ensure stable housing by increasing the maximum benefit of Maines Property Tax Fairness Credit. 22450 and 53150.

Once the annuitization or. Another way for retirees to lower their tax burden is to relocate to a state that doesnt tax Social Security.

Maine Estate Tax Everything You Need To Know Smartasset

Ask Hannah Holmes What Is The Best Natural Way To Battle Weeds Colonial Renovation Holmes Closed Cell Foam

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Military Retirees Retirement Retired Military Military Retirement

Maine Retirement Tax Friendliness Smartasset

Maine Income Tax Calculator Smartasset

Maine Tax Forms And Instructions For 2021 Form 1040me

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Walmart Lowe S Among Big Retailers Scheming To Avoid Maine Property Taxes Beacon Property Tax Walmart Tax

Maine Property Tax Rates By Town The Master List

Tax Maps And Valuation Listings Maine Revenue Services

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz